Test Prep CPA-REGULATION dumps - 100% Pass Guarantee!

Vendor: Test Prep

Certifications: Test Prep Certifications

Exam Name: CPA Regulation

Exam Code: CPA-REGULATION

Total Questions: 69 Q&As ( View Details)

Last Updated: Mar 18, 2025

Note: Product instant download. Please sign in and click My account to download your product.

- Q&As Identical to the VCE Product

- Windows, Mac, Linux, Mobile Phone

- Printable PDF without Watermark

- Instant Download Access

- Download Free PDF Demo

- Includes 365 Days of Free Updates

VCE

- Q&As Identical to the PDF Product

- Windows Only

- Simulates a Real Exam Environment

- Review Test History and Performance

- Instant Download Access

- Includes 365 Days of Free Updates

Test Prep CPA-REGULATION Last Month Results

98.9% Pass Rate

98.9% Pass Rate 365 Days Free Update

365 Days Free Update Verified By Professional IT Experts

Verified By Professional IT Experts 24/7 Live Support

24/7 Live Support Instant Download PDF&VCE

Instant Download PDF&VCE 3 Days Preparation Before Test

3 Days Preparation Before Test 18 Years Experience

18 Years Experience 6000+ IT Exam Dumps

6000+ IT Exam Dumps 100% Safe Shopping Experience

100% Safe Shopping Experience

CPA-REGULATION Q&A's Detail

| Exam Code: | CPA-REGULATION |

| Total Questions: | 69 |

| Single & Multiple Choice | 69 |

CertBus Has the Latest CPA-REGULATION Exam Dumps in Both PDF and VCE Format

- Test Prep_certbus_CPA-REGULATION_by_hieunguyen_68.pdf

- 230.26 KB

- Test Prep_certbus_CPA-REGULATION_by_Nixon_58.pdf

- 262.28 KB

- Test Prep_certbus_CPA-REGULATION_by_Farhan_khan_68.pdf

- 243.48 KB

- Test Prep_certbus_CPA-REGULATION_by_futureCCIE_55.pdf

- 309.02 KB

- Test Prep_certbus_CPA-REGULATION_by_Mahmood_56.pdf

- 273.9 KB

- Test Prep_certbus_CPA-REGULATION_by_Comment_60.pdf

- 238.03 KB

CPA-REGULATION Online Practice Questions and Answers

Barkley owns a vacation cabin that was rented to unrelated parties for 10 days during the year for $2,500. The cabin was used personally by Barkley for three months and left vacant for the rest of the year. Expenses for the cabin were as follows:

Real estate taxes $1,000 Maintenance and utilities $2,000

How much rental income (loss) is included in Barkley's adjusted gross income?

A. $0

B. $500

C. $(500)

D. $(1,500)

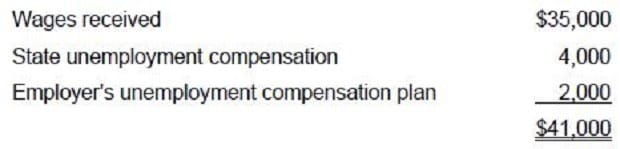

Porter was unemployed for part of the year. Porter received $35,000 of wages, $4,000 from a state unemployment compensation plan, and $2,000 from his former employer's company-paid supplemental unemployment benefit plan. What is the amount of Porter's gross income?

A. $35,000

B. $37,000

C. $39,000

D. $41,000

Which of the following is subject to the Uniform Capitalization Rules of Code Sec. 263A?

A. Editorial costs incurred by a freelance writer.

B. Research and experimental expenditures.

C. Mine development and exploration costs.

D. Warehousing costs incurred by a manufacturing company with $12 million in annual gross receipts.

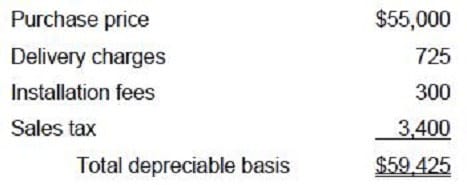

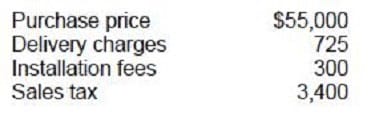

Starr, a self-employed individual, purchased a piece of equipment for use in Starr's business. The costs associated with the acquisition of the equipment were:

What is the depreciable basis of the equipment?

A. $55,000

B. $58,400

C. $59,125

D. $59,425

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040. The Moores received a stock dividend in 1994 from Ace Corp. They had the option to receive either cash or Ace stock with a fair market value of $900 as of the date of distribution. The par value of the stock was $500.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000

K. $10,000

L. $25,000

M. $50,000

N. $55,000

O. $75,000

Add Comments

Success Stories

- MA

- kpusmc

- Mar 22, 2025

- Rating: 5.0 / 5.0

My only complaint with this dumps is that it is sometimes repetitive, repeating concepts multiple times throughout some questions; which I suppose is a result of the domains not being covered in a linear fashion. Everything else is good enough for you to pass your exam.

- Lueilwitz

- Corkery

- Mar 22, 2025

- Rating: 5.0 / 5.0

I passed my CPA-REGULATION with this dumps so I want to share tips with you. Check the exam outline. You need to know which topics are required in the actual exam. Then you can make your plan targeted. Spend more time on that topic are much more harder than others. I got all same questions from this dumps. Some may changed slightly (sequence of the options for example). So be sure to read your questionscarefully. That’s the most important tip for all candidates.

- Turkey

- Adonis

- Mar 17, 2025

- Rating: 4.9 / 5.0

![]()

this dumps is valid. thanks for your help.

- Pakistan

- Lloyd

- Mar 17, 2025

- Rating: 4.3 / 5.0

![]()

this dumps is valid. All questions that I met in the exam are from this dumps !!!

- Luxembourg

- 10.110.0.5

- Mar 17, 2025

- Rating: 5.0 / 5.0

![]()

Valid dumps. Answers are accurate. I come get few new questions in the exam. Maybe 2-3 VERY SIMPLE. Good Luck All!!!!

- India

- IMlegend

- Mar 16, 2025

- Rating: 4.7 / 5.0

![]()

i'm very happy that i passed the exam successfully. Recommend.

- United States

- Jimmy

- Mar 16, 2025

- Rating: 5.0 / 5.0

![]()

Thank you for providing this very accurate exam dumps! There are great hints throughout your material that apply to studying any new subject. I agree completely about learning memorization tricks. One of my other tricks is to remember the content of the correct option.

- Sri Lanka

- Miltenberger

- Mar 14, 2025

- Rating: 4.8 / 5.0

![]()

passed today. I think it is very useful and enough for your exam, so trust on it and you will achieve success.

- Myanmar

- Dean

- Mar 14, 2025

- Rating: 4.1 / 5.0

![]()

This dumps is helpful and convenient, you can trust on it .Good luck to you.

- South Africa

- Nebeker

- Mar 14, 2025

- Rating: 4.4 / 5.0

![]()

This dumps is very valid and is enough to your exam, so just trust on it and do it carefully.

Printable PDF

Printable PDF