CPA-REGULATION Online Practice Questions and Answers

In evaluating the hierarchy of authority in tax law, which of the following carries the greatest authoritative value for tax planning of transactions?

A. Internal Revenue Code.

B. IRS regulations.

C. Tax court decisions.

D. IRS agents' reports.

In 19X4, Smith, a divorced person, provided over one half the support for his widowed mother, Ruth, and his son, Clay, both of whom are U.S. citizens. During 19X4, Ruth did not live with Smith. She received $9,000 in Social Security benefits. Clay, a 25 year-old full-time graduate student, and his wife lived with Smith. Clay had no income but filed a joint return for 19X4, owing an additional $500 in taxes on his wife's income. How many exemptions was Smith entitled to claim on his 19X4 tax return?

A. 4

B. 3

C. 2

D. 1

Darr, an employee of Sorce C corporation, is not a shareholder. Which of the following would be included in a taxpayer's gross income?

A. Employer-provided medical insurance coverage under a health plan.

B. A $10,000 gift from the taxpayer's grandparents.

C. The fair market value of land that the taxpayer inherited from an uncle.

D. The dividend income on shares of stock that the taxpayer received for services rendered.

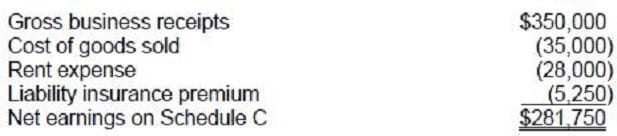

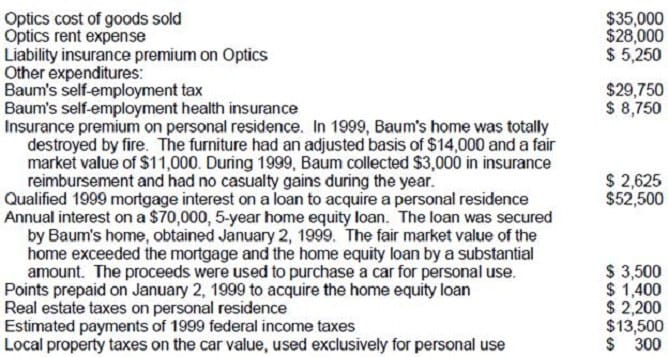

Baum, an unmarried optometrist and sole proprietor of Optics, buys and maintains a supply of eyeglasses and frames to sell in the ordinary course of business. In 1999, Optics had $350,000 in gross business receipts and its year-end inventory was not subject to the uniform capitalization rules. Baum's 1999 adjusted gross income was $90,000 and Baum qualified to itemize deductions. During 1999, Baum recorded the following information: Business expenses:

What amount should Baum report as 1999 net earnings from self-employment?

A. $243,250

B. $252,000

C. $273,000

D. $281,750

On December 1, 1992, Michaels, a self-employed cash basis taxpayer, borrowed $100,000 to use in her business. The loan was to be repaid on November 30, 1993. Michaels paid the entire interest of $12,000 on December 1, 1992. What amount of interest was deductible on Michaels' 1993 income tax return?

A. $12,000

B. $11,000

C. $1,000

D. $0

DAC Foundation awarded Kent $75,000 in recognition of lifelong literary achievement. Kent was not required to render future services as a condition to receive the $75,000. What condition(s) must have been met for the award to be excluded from Kent's gross income?

I. Kent was selected for the award by DAC without any action on Kent's part.

II.

Pursuant to Kent's designation, DAC paid the amount of the award either to a governmental unit or to a charitable organization.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Neither I nor II.

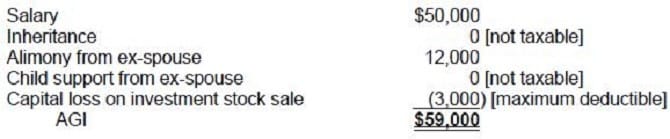

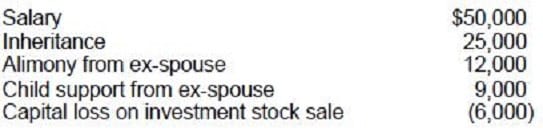

In the current year Jensen had the following items:

What is Jensen's AGI for the current year?

A. $44,000

B. $59,000

C. $62,000

D. $84,000

Capital assets include:

A. A corporation's accounts receivable from the sale of its inventory.

B. Seven-year MACRS property used in a corporation's trade or business.

C. A manufacturing company's investment in U.S. Treasury bonds.

D. A corporate real estate developer's unimproved land that is to be subdivided to build homes, which will be sold to customers.

Which of the following sales should be reported as a capital gain?

A. Sale of equipment.

B. Real property subdivided and sold by a dealer.

C. Sale of inventory.

D. Government bonds sold by an individual investor.

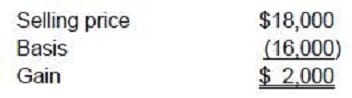

Gibson purchased stock with a fair market value of $14,000 from Gibson's adult child for $12,000. The child's cost basis in the stock at the date of sale was $16,000. Gibson sold the same stock to an unrelated party for $18,000. What is Gibson's recognized gain from the sale?

A. $0

B. $2,000

C. $4,000

D. $6,000

Clark bought Series EE U.S. Savings Bonds after 1989. Redemption proceeds will be used for payment of college tuition for Clark's dependent child. One of the conditions that must be met for tax exemption of accumulated interest on these bonds is that the:

A. Purchaser of the bonds must be the sole owner of the bonds (or joint owner with his or her spouse).

B. Bonds must be bought by a parent (or both parents) and put in the name of the dependent child.

C. Bonds must be bought by the owner of the bonds before the owner reaches the age of 24.

D. Bonds must be transferred to the college for redemption by the college rather than by the owner of the bonds.

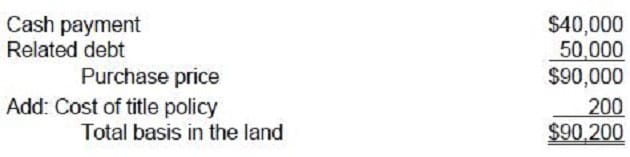

Fred Berk bought a plot of land with a cash payment of $40,000 and a mortgage of $50,000. In addition, Berk paid $200 for a title insurance policy. Berk's basis in this land is:

A. $40,000

B. $40,200

C. $90,000

D. $90,200

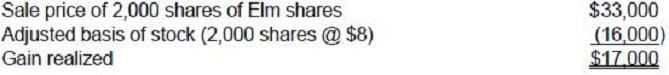

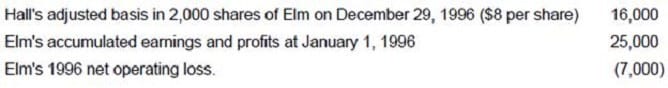

Elm Corp. is an accrual-basis calendar-year C corporation with 100,000 shares of voting common stock issued and outstanding as of December 28, 1996. On Friday, December 29, 1996, Hall surrendered 2,000 shares of Elm stock to Elm in exchange for $33,000 cash. Hall had no direct or indirect interest in Elm after the stock surrender. Additional information follows:

What amount of income did Hall recognize from the stock surrender?

A. $33,000 dividend.

B. $25,000 dividend.

C. $18,000 capital gain.

D. $17,000 capital gain.

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040. Tom's 1994 wages were $53,000. In addition, Tom's employer provided group-term life insurance on Tom's life in excess of $50,000. The value of such excess coverage was $2,000.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000

K. $10,000

L. $25,000

M. $50,000

N. $55,000

O. $75,000

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040. In 1994, Joan received $1,300 in unemployment compensation benefits. Her employer made a $100 contribution to the unemployment insurance fund on her behalf.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000

K. $10,000

L. $25,000

M. $50,000

N. $55,000

O. $75,000