PEGAPCDC85V1 Online Practice Questions and Answers

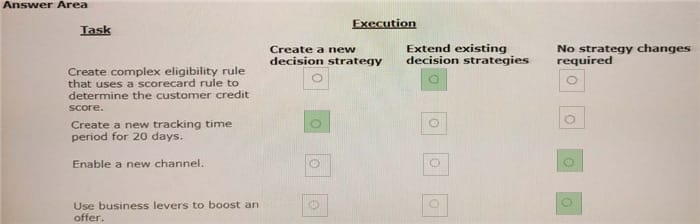

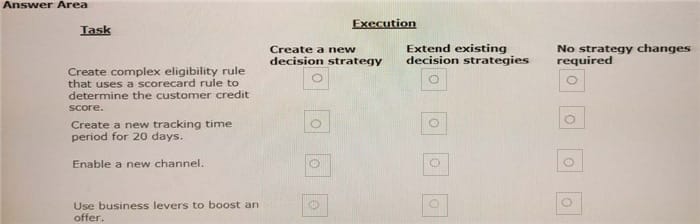

U+ Bank, a retail bank, presents offers on its website by using Pega Customer Decision Hub The bank wants to leverage Customer Decision Hub capabilities to present relevant offers to qualified customers. As a decisioning consultant,

you are responsible for configuring the business requirements with the Next-Best-Action Designer, which involves several tasks. To accomplish these tasks, you might have to use auto-generated decision strategies, create new decision

strategies, or edit existing strategies.

In the Answer Area, select the correct execution for each Task.

Hot Area:

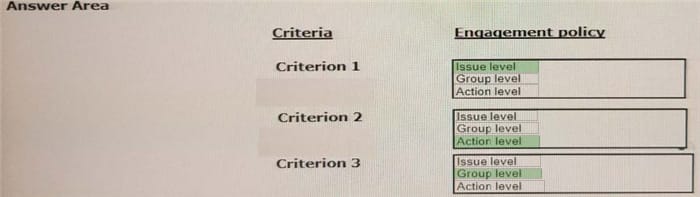

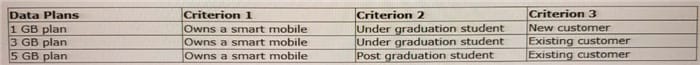

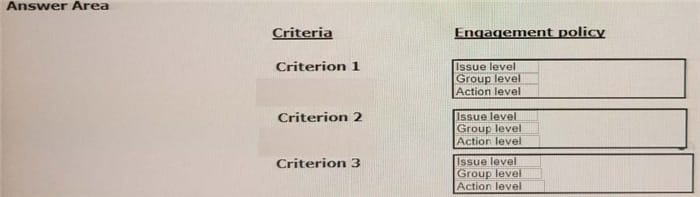

Myco, a telecom company, has come up with a new data plan group to suit its customers' needs. The below table lists the three data plan actions and the criteria a customer should satisfy to qualify for the offer.

How do you configure the engagement policies to implement this requirement?

Hot Area:

In Pega Customer Decision HubTM, the characteristics of an action are defined by using

A. properties

B. logos

C. plain text

D. banners

MyCo, a telecom company, wants to send promotional emails to give away phone accessories. The accessories can only be given away in batches of 50. When the stock in a batch is completed, a new batch can be promoted again.

You have decided to use volume constraint to limit the number of actions in a batch. To meet the business requirement, what Reset Interval setting do you select?

A. When accessed

B. Manual

C. Daily

D. Reset Interval does not matter for this scenario

U+ Bank, a retail bank, follows all engagement policy best practices to present credit card offers on their website. The bank has introduced a new credit card offer, the Rewards card. Anna, an existing customer, currently holds a higher value card. Premier Rewards, and does not see the new Rewards card offer.

What condition possibly prevents Anna from seeing the new Rewards card offer?

A. Applicability

B. Suppression rules

C. Suitability

D. Eligibility

As a decisioning consultant, you advise the board on the business issues for which they must use the Next-Best-Action strategy.

Which three business issues do you recommend? (Choose Three)

A. Collections

B. Service

C. Retention

D. Resource Planning

E. Accounting

U+ Bank, a retail bank, wants to include offer related images in the emails that they send to their qualified customers. As a decisioning consultant, what best practice must you follow to include images in the emails?

A. Provide links to images in the email

B. Host images on an external server

C. Embed images in the email directly

D. Attach images to the email

What does a solid arrow from a "Set Property" component to a "Filter" component mean?

A. There is a one-to-one relationship between a "Set Property" and a "Filter" component.

B. A property from the "Set Property" component is referenced by the "Filter" component.

C. To evaluate the "Set Property" component, the "Filter" component is evaluated first.

D. Information from the "Set Property" component is copied over to the "Filter" component.

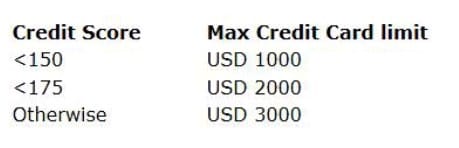

U+ Bank uses a Next-Best-Action decision strategy to automatically approve credit card limit changes requested by customers. A scorecard model determines the customer credit score. The automatic approval of credit card limits are processed based on the following criteria set by the bank:

The bank wants to change the threshold value for the USD 2000 credit limit from "<175" to "<200". As a Strategy Designer, how do you implement this change?

A. Change in the strategy the condition from ".pxSegment <=175" to ".pxSegment <=200"

B. Map the score value in the decision strategy to "<=200".

C. Change the cutoff value in the results tab of the scorecard decision component

D. Change the cutoff value in the results tab of the scorecard model

In a Decisioning Strategy, which decision component is required to enable access to the Customer properties like age, income, etc.?

A. None, properties are available

B. Set Property

C. Data Import

D. Proposition Data

U+ Bank, a retail bank, uses the always-on outbound approach to send outbound messages on different channels such as email, SMS, and push notifications. There are a variety of action flow patterns in use to meet various business and

channel integrations requirements.

Due to technical reasons, the bank wants to temporarily suspend sending outbound messages and instead write the selected customers and action details to a database table for later offline processing.

What is the most efficient way to meet this requirement?

A. Add a new Send shape in all the action flows.

B. Set up a secondary schedule.

C. Bypass action flow processing.

D. Update the Send shape with Finalization.

Using Pega Customer Decision Hub, a mobile company transitions from a one-to-many to a one-to-one marketing approach.

The company is introducing a new data plan.

To offer the new data plan, what must the mobile company focus on when implementing the Next-Best-Action paradigm?

A. Offer the new retention plan for all customers in a certain region

B. Meet the quarterly targets regardless of customer needs

C. Maximize customer churn for low-value customers

D. Customer relevancy and business profitability

You are the decisioning consultant on an Al-powered one-to-one customer engagement implementation project. You are asked to design the next-best-action prioritization expression that balances the customer needs with the business objectives.

What factor do you consider in the prioritization expression?

A. Predicted customer behavior

B. Customer contact policy

C. Offer eligibility

D. Offer relevancy

U+ Bank has recently started using Pega Customer Decision HubTM to display the first credit card offer, the Standard card, to every customer who logs in to their website.

Which three tasks do you need to perform to implement this requirement? (Choose Three)

A. Set up business structure to Sales/CreditCards

B. Define customer engagement polices

C. Create and configure the real-time container

D. Create the action and its web treatment

E. Define customer contact policies

U+ Bank, a retail bank, wants to begin promoting credit card offers via email to qualified customers. The business would like to ensure that the outbound run always uses the latest customer information.

What do you configure to implement this requirement?

A. Trigger an external ETL (Extract-Transform-Load) process

B. Select Refresh the audience

C. Run the starting population segment daily

D. Select different audience sample with similar profile