IMANET-CMA Online Practice Questions and Answers

A firm's statement of broad objectives or mission statement should accomplish all of the following except?

A. Outlining strategies for technological development, market expansion, and product differentiation.

B. Defining the purpose of the company.

C. Providing an overall guide to those in high-level, decision-making position.

D. Stating the moral and ethical principles that guide the action of the firm.

An organization's policies and procedures are part of its overall system of internal controls. The control function performed by policies and procedures is

A. Feedforward control

B. Implementation control

C. Feedback control

D. Application control

The marketing organization may take which forms?

l.

A cross-disciplinary team ll. A sales department team lll. Separate sales and marketing departments lV. Sales and marketing reporting to a vice-president

A.

l and lV only

B.

l and ll only

C.

ll, lll, and lV only

D.

l, ll, ll, iV

Governments restrict trade to

I. Help foster new industries.

II.

Protect declining industries. Ill. Increase tax revenues.

A.

lon'.

B.

land II only.

C.

II and Ill only.

D.

I, II, and Ill.

An example of a governmental impediment to global competition is k High storage costs.

A. Labor regulations.

B. High information and search costs.

C. Greater responsiveness by local firms.

Which one of the following statements is most likely to be true if a seller extends creditor a purchaser for a period of time longer than the purchaser's operating cycle? The seller A. Will have a lower level of accounts receivable than those companies whose credit period is shorter than the purchaser's operating cycle.

A. Will have a lower level of accounts receivable than those companies whose credit period is shorter than the purchaser's operating cycle.

B. Is, in effect, financing more than just the purchaser's inventory needs.

C. Can be certain that the purchaser will be able to convert the inventory into cash before payment is due.

D. Has no need for a stated discount rate or credit period.

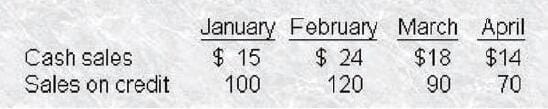

Shown below is a forecast of sales for Cooper Inc. for the first 4 months of the year (all amounts are in thousands of dollars).

On average, 50% of credit sales are paid for in the month of sale, 30% in the month following the sale, and the remainder is paid 2 months after the month of sale. Assuming there are no bad debts1the expected cash inflows for Cooper in March is

A. $138,000

B. $122,000

C. $119,000

D. $108,000

A working capital technique that increases the payable float and therefore delays the outflow of cash is

A. Concentration banking.

B. A draft.

C. Electronic Data Interchange (EDI).

D. A lockbox system.

An organization's executive committee, meeting to solve an important problem, spent 30 minutes analyzing data and debating the cause of the problem. Finally, they agreed and could move onto the next step. Possible steps in the creative problem-solving process are listed below. Which step should the committee perform next?

A. Select a solution.

B. Generate alternative solutions.

C. Identify the problem.

D. Consider the reaction of competitors to various courses of action.

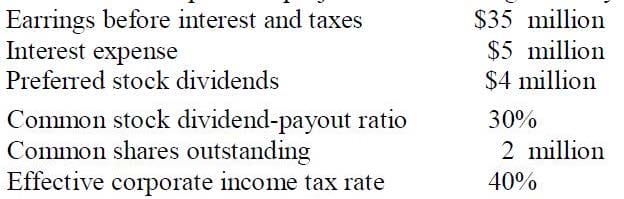

The Dawson Corporation projects the following for the year Earrings before interest and taxes $35 million

The expected common stock dividend per share for Dawson Corporation is The company's net income is $18,000,000 [($35,000,000 EBIT - $5,000,000 interest) x (1.0 – .4 tax rate)]. Thus, the earnings available to common shareholders equal $14,000,000 ($18,000,000 - $4,000,000 preferred dividends), and EPS is $7 ($14,000,000 ÷ 2,000,000 common shares). Given a dividend-payout ratio of 30%, the dividend to common shareholders is expected to be $2.10 per share ($7 x 30%).

A. $2.34

B. $2.70

C. $1.80

D. $2.10

On August 15, 19XX, National Corporation announced a 1-for-10 reverse split, the event to occur on September 6, subject to shareholder approval. The stock's closing price on August 14 was $1.375. If nothing changes, at what price would you expect the stock to sell after the stock split is made effective on September 6?

A. $13.75

B. $10.00

C. $2.75

D. $1.38

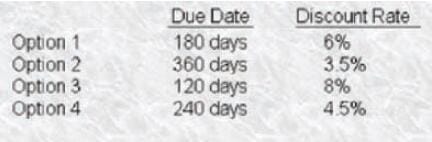

Hendnx, Inc. is interested in purchasing a $100 U.S. Treasury bill and was presented with the following options:

If Hendrix wishes to buy the Treasury bill at the lowest purchasing price, which option should be chosen, assuming a 360- day year?

A. Option 1.

B. Option 2.

C. Option 3.

D. Option 4.

The prime lending rate of commercial banks is an announced rate and is often understated from the viewpoint of even the most credit-worthy firms. Which one of the following requirements always results in a higher effective interest rate?

A. A floating rate for the loan period

B. A covenant that restricts the issuance of any new unsecured bonds during the existence of the loan.

C. The imposition of a compensating balance with an absolute minimum that cannot be met by current transaction balances.

D. The absence of a charge for any unused portion in the line of credit.

A cost that may be eliminated by performing an activity more efficiently is a(n)

A. Opportunity cost.

B. Avoidable cost.

C. Cost driver.

D. Indirect cost.

The ratio of fixed costs to the unit contribution margin is the?

A. Breakeven point

B. Profit margin.

C. Operating profit

D. Contribution margin ratio.