CMA Online Practice Questions and Answers

Market-based pricing bases prices on

A. The choice of products offered as accessions and those offered as standard features.

B. The products perceived value and the competitor's actions.

C. A relativity low ratio of price to quality delivered.

D. Differentiation of prices by geographic region.

The degree of operating leverage for Carlisle Company is

A. 24

B. 178

C. 1.35

D. 1.2

A firm has daily cash receipts of $300,000 and is interested in acquiring a lockbox service in order to reduce collection time. Bank l's lockbox service costs $3,000 per month and will reduce collection time by 3 days. Bank 2's lockbox service costs $5,000 per month and will reduce collection time by 4 days. Bank 3's lockbox service costs $500 per month and will reduce collection time by 1 day. Bank 4's lockbox service costs $1,000 per month and will reduce collection time by 2 days. If money market rates are expected to average 6% during the year, and the firm wishes to maximize income, which bank should the firm choose?

A. Bank 1.

B. Bank2.

C. Bank3.

D. Bank4.

All of the following are examples of imputed costs except

A. The stated interest paid on a bank loan.

B. The use of the firm's internal cash funds to purchase assets.

C. Assets that are considered obsolete that maintain a net book value.

D. Decelerated depreciation.

When choosing the best available solution to a problem, human aspects of the choice must be considered. Which is a true statement regarding human aspects of the choice?

A. The opinions and attitudes of the people involved do not require consideration.

B. The people involved do not have to be convinced of the decision's value.

C. Decisions do not have unexpected effects.

D. Implementing change is a critical part of the decision-making process.

The modeling technique to be used for situations involving a sequence of events with several possible outcomes associated with each event is

A. Queuing theory.

B. Simulation.

C. Linear programming.

D. Decision tree analysis.

Francis wants to create an endowment income of $15,500 a year for the Cancer Research Center at the Municipal Hospital. She proposes that the first payment not be made for 3 years' time. if Francis can earn a return of 6% on her investments, what amount should she invest now?

A. $216,999.99

B. $243,608.33

C. $229,916.66

D. $258,333.33

Which one of the following is most relevant to a manufacturing equipment replacement decision?

A. Original cost of the old equipment.

B. Disposal price of the old equipment.

C. Gain or loss on the disposal of the old equipment.

D. A lump-sum write-off amount from the disposal of the old equipment.

Which concept of costs includes only explicit costs?

A. Economic.

B. Opportunity

C. Accounting.

D. Sunk.

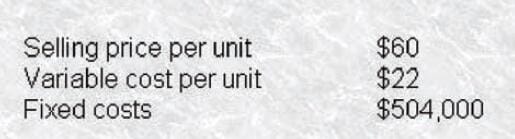

Austin Manufacturing, which is subject to a 40% income tax rate, had the following operating data for the period just ended.

Management plans to improve the quality of its sole product by (1) replacing a component that costs $3.50 with a higher-grade unit that costs $5.50, and (2) acquiring a $180,000 packing machine. Austin will depreciate the machine over a 10-year life with no estimated salvage value by the straight-line method of depreciation. If the company wants to earn after-tax income of $172,800 in the upcoming period, it must sell

A. 19,300 units.

B. 21,316 units.

C. 22,500 units.

D. 23,800 units.

Mesa Company is considering an investment to open a new banana processing division. The project in question would entail an initial investment of $45000, and as a result of the project cash inflows of $20000 can be expected in each of the next 3 years. The hurdle rate is 10%. What is the profitability index for the project?

A. 1.0784

B. 1.1053

C. 1.1379

D. 1.1771

What is the opportunity cost of making a component part in a factory given no alternative use of the capacity?

A. The variable manufacturing cost of the component.

B. The total manufacturing cost of the component.

C. The total variable cost of the component.

D. Zero.

The Eastern division sells goods internally to the Western division of the same company. The quoted external price in industry publications from a supplier near Eastern is $200 per ton plus transportation. It costs $20 per ton to transport the goods to Western. Eastern's actual market cost per ton to buy the direct materials to make the transferred product is $100. Actual per-ton direct labor is $50. Other actual costs of storage and handling are $40. The company president selects a $220 transfer price. This is an example of

A. Market-based transfer pricing

B. Cost-based transfer pricing

C. Negotiated transfer pricing.

D. Cost plus 20% transfer pricing.

Pazer, Inc produces portable televisions. Pazer's product manager proposes to increase the cost structure by adding voice-activated volume/channel controls to the television, and also adding three additional repair personnel to deal with products returned due to defects, Are these costs value-added or nonvalue-added? Cost of Voice-Activated Controls Cost of Additional Repair Personnel

A. Value-added Value-added

B. Value-added Nonvalue-added

C. Norivalue-added Value-added D. Nonvalue-added Nonvalue-added

The management of Pelican, Inc. is evaluating a proposed acquisition of a new machine at a purchase price of $180,000 and with installation costs of $10,000. A $9,000 increase in working capital will be required. The machine Will have a useful life of four years, after which it can be sold for $30,000. The estimated annual incremental operating revenues and cash operating expenses are $450,000 and $300.000, respectively, for each of the four years. Pelican's effective income tax rate is 40%. and the cost of capital is 12%. Pelican uses straight-line depreciation for both financial reporting and income tax purposes. If the project is accepted, the estimated incremental after-tax operating cash flows at the end of the first year wilt be?

A. $99,000

B. $106,000

C. $108,000

D. $150,000