CIMAPRO19-P02-1 Online Practice Questions and Answers

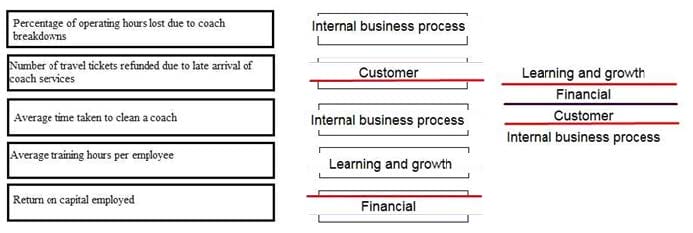

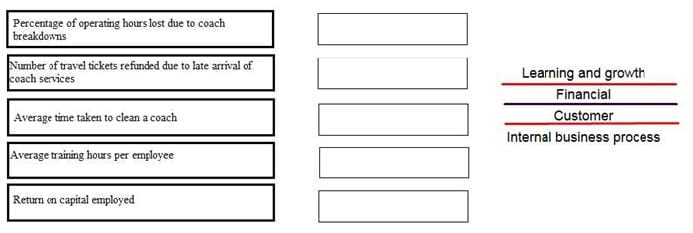

DRAG DROP

A Balanced Scorecard is being prepared for a coach passenger transport company. Place the correct perspective of the Balanced Scorecard against each performance measure.

Select and Place:

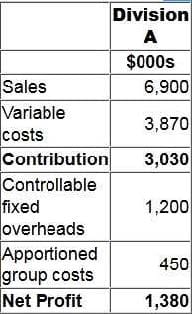

Division A is an investment centre with assets of $7.3 million. The following is an extract from the annual budget for division A:

The cost of capital is 14%.

Calculate the residual income for division A.

A. $808,000

B. $1,727,800

C. $358,000

D. $2,008,000

A company's competitor has just launched a rival product at a selling price of $38 per unit. Until now the company's selling price of $41.60 per unit has achieved a 30% mark-up on the product's unit cost. The company proposes to use a target

costing approach to pricing to remain competitive. Management has decided to match the competitor's selling price and has set a target cost to achieve a 20% return on the target price.

What is the cost gap?

A. $1.60

B. $3.60

C. $0.33

D. $1.28

A project has a positive net present value (NPV) when discounted at a company's weighted average cost of capital (WACC). The project has also been evaluated using a range of other investment appraisal techniques.

It has now been recognized that the project is of much higher risk than the average risk of the company's existing portfolio of projects. It has therefore been decided that the discount rate to be used when evaluating this project should be the

WACC adjusted for risk. As the result of changing the discount rate as described, which of following statements are correct? Select ALL that apply.

A. The net present value would decrease.

B. The internal rate of return would decrease.

C. The accounting rate of return would decrease.

D. The internal rate of return would remain unchanged.

E. The profitability index would remain unchanged.

F. The net present value would increase.

There is a 60% probability of a project yielding a positive net present value (NPV) of $280,000 and a 30% probability of it yielding a positive NPV of $140,000. The only other possible outcome is that the project will yield a negative NPV of

$160,000.

What is the expected value of the project's NPV?

A. $194,000

B. $210,000

C. $280,000

D. $260,000

Which TWO of the following actions taken during the budgetary planning process will result in the creation of budgetary slack?

A. Overestimating costs

B. Underestimating costs

C. Underestimating revenues

D. Overestimating revenues

E. Overestimating profit

Which of the following statements about modified internal rate of return (MIRR) and internal rate of return (IRR) is correct?

A. MIRR uses a more realistic reinvestment assumption than IRR.

B. MIRR favours projects with long payback periods whereas IRR does not.

C. MIRR and IRR will always rank competing projects in the same order.

D. A project's MIRR will always be higher than its IRR.

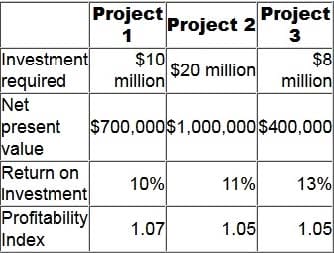

A company has a cost of capital of 12% and a maximum of $20 million to invest. It has identified three possible investment projects, none of which is divisible, as follows.

Which project(s) should the company invest in?

A. Project 1 only

B. Project 2 only

C. Project 3 only

D. Projects 1 and 3 only

Which of the following is a valid objective of a transfer pricing system?

A. To achieve divisional autonomy

B. To maintain head office control

C. To establish centralised decision making

D. To develop a top-down culture

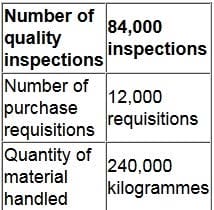

A company makes three products, E, F and G. Total overheads for the year are expected to be $1.2 million, with the following split between cost pools: Cost driver information has been estimated as follows:

The company plans to make 10,000 units of product E in the year, with an expected direct cost of $0.60 per unit. This annual production of product E is expected to require 20 quality inspections, 28 purchase requisitions, and 400

kilogrammes of materials.

What is the overhead cost per unit of product E?

A. $0.10

B. $0.70

C. $3.57

D. $4.17

The directors of a company wish to evaluate two mutually exclusive capital investment projects. Both projects have conventional cash flows: an initial outflow followed by a series of annual cash inflows. The directors are aware of the following three investment appraisal methods: internal rate of return (IRR), net present value (NPV) and accounting rate of return (ARR). The directors have asked for your advice about which method should be used to evaluate these two projects. Which of the following is valid advice to give to the directors?

A. IRR should be used because both NPV and ARR could lead to an incorrect investment decision.

B. ARR should be used because it is based on profit whereas both IRR and NPV are based on cash flows.

C. IRR should NOT be used because it could result in multiple IRRs.

D. NPV should be used because it focuses on wealth creation whereas IRR and ARR are both relative measures.

The Chief Executive of a large manufacturing company has made the following comment. "All of our competitors are using both just-in-time(JIT) and Total Quality Management (TQM) whereas we have never used either. Consequently we are

lagging behind our competitors because their levels of inventory and quality costs are significantly below ours. I want to see JIT fully implemented, both for purchasing and for production, in 4 weeks' time and TQM fully implemented 4 weeks

after that."

Which of the following provide appropriate advice to the Chief Executive? Select ALL that apply.

A. Full implementation of JIT is unlikely to be successful unless a TQM environment has first been established.

B. Implementing TQM from scratch within 8 weeks should be feasible for a large manufacturing company, but implementing JIT within 4 weeks is unlikely to be feasible.

C. Total quality costs are likely to begin declining immediately once the process of implementing TQM has commenced.

D. JIT offers the long run prospect of significantly reducing inventory.

E. It would be possible to implement TQM without implementing JIT.

F. It is not possible to implement JIT for production without first implementing JIT for purchasing.

Which of the following statements is NOT correct?

Transfer prices between responsibility centers should be set at a level that:

A. provides an artificial selling price that enables the transferring division to earn a return for its efforts and the receiving division to incur a cost for benefits received.

B. enables profit centre performance to be measured 'commercially'.

C. encourages a balance of goal congruence, managerial effort and centralized management.

D. encourages profit centre managers to agree on the amount of goods and services to be transferred at a level that is consistent with organizational aims.

SkillWeave Industries are focused on managing the risk of selling their cars to the region due to economic turmoil, and have now begun using funds from sales in the region to fund supplier purchases from that region to reduce the risk from

the volatile currency. However, SkillWeave want to go a step further and make the risk even less sizeable.

Which of the following is a method by which SkillWeave can operate in the market and transfer the risk of exchange rate exposure to another party?

A. Invoice international sales in domestic currency

B. Temporarily stop operating in that target market

C. Arrange a forward foreign exchange rate contract agreeing to buy a given amount of the foreign currency in 3 months time for a fixed exchange rate based on current rates

D. Put a sale on all vehicles stationed in the region to clear stock quickly

We have 2 divisions with the following information: Profit before depreciation: B1=$800,000, B2=S1,000,000; Assets: B1 =$2,000,000, B2=S3,000,000; Capital employed: B1 = $1,700,000 and B2 = $2,550,000. 20% straight-line depreciation

is used.

Calculate ROI for each division.

A. ROI for B1 is 47% and ROI for B2 is 39.2%

B. ROI for B1 is 25.5% and ROI for B2 is 17.7%

C. ROI for B1 is 23.5% and ROI for B2 is 23.5%

D. ROI for B1 is 23.5% and ROI for B2 is 15.7%