CIMAPRO17-BA2-X1-ENG Online Practice Questions and Answers

FILL BLANK

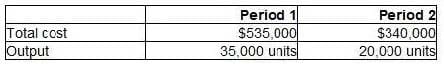

The records of a manufacturing company show the following relationship between total cost and output.

The budgeted output for Period 3 is 27,000 units. Assume that previous cost behaviour patterns will continue.

What is the total budgeted cost for Period 3?

Give your answer in the nearest whole number.

A. 431000

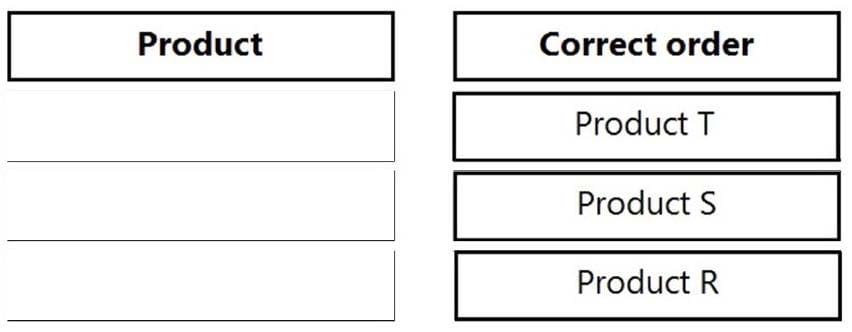

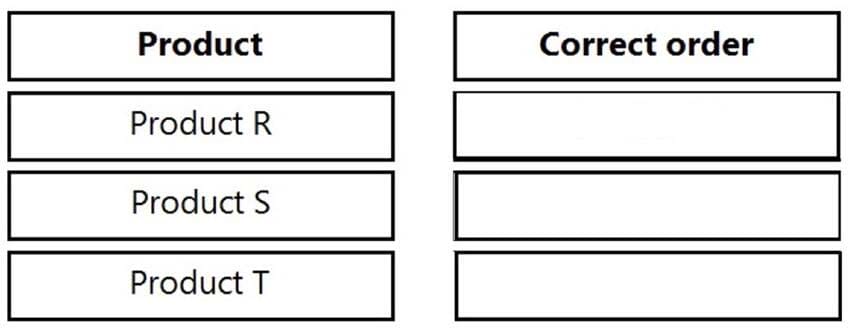

DRAG DROP

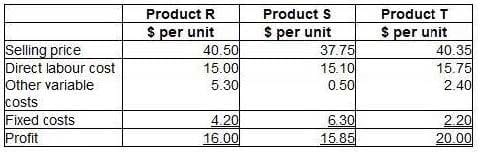

A company manufactures three products using the same direct labour which will be in short supply next month. No inventories are held. Data for the three products are as follows:

The fixed costs are all committed costs and cannot now be altered for the next month.

Place the labels against the correct product to indicate the order of priority for manufacture that will maximise the profit for the next month.

Select and Place:

The staffing policy for a supermarket is to have one cashier station open for every forecasted 20 customers per hour. Cashiers are hired by the hour as and when required, and do not perform any other duties. The cost of the cashiers in relation to the number of customers would be classified as which type of cost?

A. Stepped fixed cost

B. Variable cost

C. Semi-variable cost

D. Fixed cost

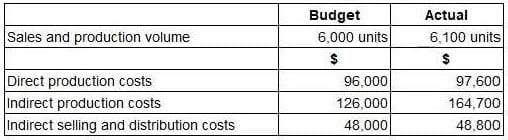

A company uses standard absorption costing. Budgeted and actual data for the latest period are as follows.

What was the production overhead absorption rate per unit?

A. $21

B. $27

C. $35

D. $29

The year-to-date results at the end of month 9 included sales revenue of $3,600,000 and variable costs of $2,100,000.

During month 10, sales revenue was $450,000 and variable costs were $270,000.

What year-to-date contribution to sales ratio (C/S ratio) would be reported at the end of month 10?

A. 58,5%

B. 70,9%

C. 41,5%

D. 40,0%

Which of the following statements relating to risk and uncertainty is correct?

A. Risk exists when we do not know all of the possible outcomes.

B. Risk exists when we know all of the possible outcomes but not their probabilities.

C. Uncertainty exists when we know all of the possible outcomes but not their probabilities.

D. Uncertainty exists when we know all of the possible outcomes and their probabilities.

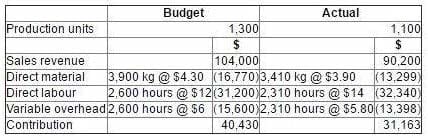

Data for the latest period for a company which makes and sells a single product are as follows:

There were no budgeted or actual changes in inventories during the period.

The variable overhead expenditure variance for the period was:

A. $462 favourable.

B. $462 adverse.

C. $2,202 favourable.

D. $2,202 adverse.

A company operates an integrated standard cost accounting system. The standard price of raw material A is $20 per litre. At the start of period 1, the inventory of 500 litres of raw material A was valued at $20 per litre. During period 1, 100 litres of raw material A were purchased at an actual price of $21 per litre. During period 2, 550 litres of raw material A were issued to Job 789.

In respect of the above events, which TWO of the following statements are correct? (Choose two.)

A. The raw material inventory at the end of period 1 should include 100 litres valued at $21 per litre.

B. An adverse material price variance should be recorded in the statement of profit or loss for period 1.

C. The raw material inventory at the end of period 2 should be valued at $20 per litre.

D. An adverse material price variance should be recorded in the statement of profit or loss for period 2.

E. The first 500 litres of raw material A issued should be debited to the Job 789 account at $20 per litre, and the remaining 50 litres at $21 per litre.

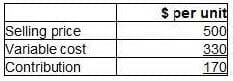

A confectionery manufacturer is considering adding a new product to the current range. Forecast data for the product are as follows.

Incremental fixed costs attributable to the new product are forecast to be $24,000 each period.

The forecast sales volume of 180 units is insufficient to achieve the target profit of $10,000 each period.

Which of the following statements is correct?

A. The margin of safety is negative because the target profit will not be achieved from the forecast sales volume.

B. If the fixed cost is changed to $20,000 the sales volume required to break even will decrease.

C. If the forecast sales volume is changed to 190 units the sales volume required to achieve the target profit will decrease.

D. If the selling price is changed to $510 the sales volume required to achieve the target profit will increase.

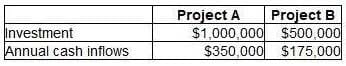

A company is appraising two projects. Both projects are for five years. Details of the two projects are as follows.

Based on the above information, which of the following statements is correct?

A. An annuity could be used to calculate the net present value of the projects.

B. The annuity factor for project A would be lower than the annuity factor for the project B.

C. A perpetuity could be used to calculate the net present value of the projects.

D. The annuity factor for project A would double the annuity factor for project B.

Which of the following is NOT a characteristic of useful operational level information?

A. Sufficiently accurate.

B. Focused on the decision to be made.

C. Available immediately.

D. Governed by financial reporting standards.

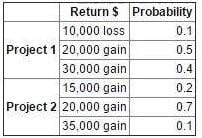

The possible returns and associated probabilities of two independent projects are as follows:

It has been decided that both projects are to be launched.

Which TWO of the following statements are correct? (Choose two.)

A. The expected value of the total return is $41,500 gain.

B. The probability of the total return being a loss is 0.10.

C. The probability of making a total return of exactly $5,000 gain is 0.02.

D. The probability of the total return being a gain is less than 1.00.

E. The expected value of the total return is $40,000 gain.

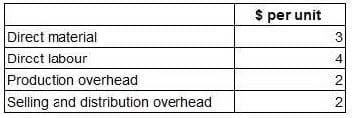

A company produces a single product for which the following cost data are available.

Analysis by the management accountant has shown that 100% of direct material cost and 50% of direct labour cost are variable costs. 50% of production overhead and 100% of selling and distribution overhead are variable costs.

What is the marginal cost per unit?

A. $6

B. $7

C. $8

D. $9

Which of the following statements regarding variances is valid?

A. Using higher quality material than standard could explain an adverse labour efficiency variance.

B. Improved maintenance of production machinery could explain an adverse material usage variance.

C. An adverse labour rate variance could explain a favourable labour efficiency variance.

D. Poor supervision could explain a favourable labour rate variance.

A company has spent $5,000 on a report into the viability of using a subcontractor. The report highlighted the following:

A machine purchased six years ago for $30,000 would become surplus to requirements. It has a written-down value of $10,000 but would be resold for $12,000.

A machine operator would be made redundant and would receive a redundancy payment of $40,000.

The administration of the subcontractor arrangement would cost the company $25,000 each year.

Which THREE of the following are relevant for the decision? (Choose three.)

A. A relevant cost of $5,000 for the viability report.

B. A relevant cost of $30,000 for the machine.

C. A relevant cost of $40,000 for the redundancy payment.

D. A relevant cost of $10,000 for the machine.

E. A relevant cost of $25,000 each year for administration.

F. A relevant revenue of $12,000 for the machine.