CIMAPRA19-F02-1 Online Practice Questions and Answers

DRAG DROP

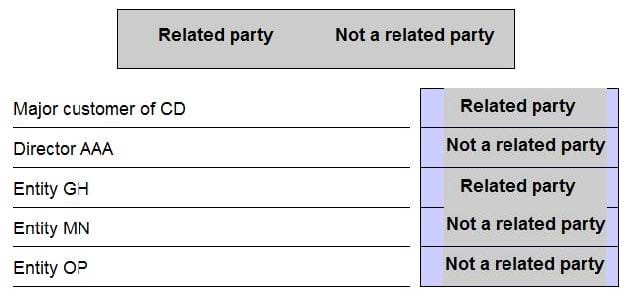

AAA is the only director of entity CD. AAA is also a director of entity GH. CD owns 30% of the equity of MN and 60% of the equity of OP.

Identify which of the following are related parties of CD by placing the appropriate response against one.

Select and Place:

AB and CD are competitors supplying components to the car manufacturing industry. AB operates in Country X and CD operates in Country Y. Both entities were incorporated on the same day, are the same size and prepare financial

statements to 31 March each year using international accounting standards.

Which of the following statements taken individually would limit the usefulness of the comparison of the return on capital employed ratio between the two entities?

A. The corporate tax rate is 25% in Country X and 40% in Country Y.

B. The average rate of inflation is 3% in Country X and 10% in Country Y.

C. The average rate of borrowing is 2% in Country X and 7% in Country Y.

D. The currency is Dollar in Country X and Krona in Country Y.

How would KL account for its investment in MN in its consolidated financial statements for the year to 31 December 20X9?

A. Joint venture

B. Joint arrangement

C. Financial asset

D. Subsidiary

On 1 January 20X7 GH purchased plant and equipment at a cost of $400,000. The temporary differences in respect of this plant and equipment at 31 December 20X7 and 20X8 have been calculated as follows:

Assume that there are no other temporary differences in the periods and that the corporate income tax rate is 25%. GH is expected to have significant taxable profits in the future.

Which of the following is the correct impact in GH's statement of financial position at 31 December 20X8 in respect of deferred tax?

A. Increase in the deferred tax asset.

B. Increase in the deferred tax liability.

C. Decrease in the deferred tax asset.

D. Decrease in the deferred tax liability.

JKL measure gearing as debt:equity, based on book values. At 31 December 20X5 the ratio is 2:3 and JKL would like this to be 2:5. Which of the following transactions individually would achieve this?

A. Bonus issue from the share premium account.

B. Revaluation of investment property to an increased fair value.

C. Repayment of a 6 year term loan with the issue of 5 year redeemable debentures.

D. Issue of redeemable preference shares at par.

The basic earning per share computed by a company for year ended 31st March 20X7 is £2 per share. The company had certain convertible debentures outstanding as on 31st March 20X7. The conversion of debentures to equity shares would result in the earnings per share to be ?.2. Which of the following should the company disclose?

A. Basic earnings per share only

B. Diluted earnings per share only

C. Both basic and diluted earnings per share

D. Neither basic nor diluted earnings per share

Which TWO of the following are true for an entity raising equity finance using a rights issue rather than a placing of equity shares to new investors?

A. The administration is more complex and therefore likely to be more costly.

B. The shares will sell at a higher price and therefore generate more funds.

C. The voting rights of existing shareholders will be unaffected if the shareholders take up their rights.

D. The cost of underwriting will be lower because the risk of the issue is lower.

E. The issue will widen the base of shareholders if all shareholders take up their rights.

GH is a listed entity which holds equity shares in one subsidiary and one associate.

Information extracted from the most recent financial statements is as follows: What is the interest cover for the year?

A. 9.6 times

B. 10.7 times

C. 11.7 times

D. 8.5 times