CCRA Online Practice Questions and Answers

Case Facts as on March 31, 2012

Mark Construction Company (MCC) has bagged a contract for construction of a large dam and hydro power project on river Shivna in Madhya Pradesh (MP). The project is also of relevance from the irrigation perspective due to its location and as per the agreement MCC will have to undertake construction of web of canals, approach road to dam, power house and other ancillary units. MCC is promoted by Mr. Thomas Mark, who is a MP from the ruling party which recently formed government in MP. Historically, MCC has been engaged into construction of rural roads, small bridges and railway platforms on contract basis for the Government. MCC will have a separate special purpose vehicle (SPV) floated for this venture.

The hydro power project comes under the public private partnership scheme of the Government of MP, where in the private partner builds owns operates and transfers (BOOT) the hydro power plant. The detailed terms of the hydro power project agreement are as follows:

1.

The construction of the dam, canals and hydro power plant shall be undertaken by the contractor. The Government of MP will have to acquire land which will submerge on construction of dam and shall rehabilitate the owners of land.

2.

MCC shall have right to operate the hydro power project from date of commencement of commercial operations (DCCO) for a period of 20 years and shall transfer the project to Government thereafter. Further, SPV shall be tax exempt for a period of five years from DCCO i.e. FY17-FY21.

3.

The power project is of 600 megawatts (MW) shall comprise 4 units of 150 MW each. The estimated cost of project is about INR3, 500 Million to be spent over a period of 4 year(s) the project is estimated to be commercially operational by April 1, 2016 with two units operational om same day and one unit each will be operational on April 1, 2017 and April 1, 2018.

4.

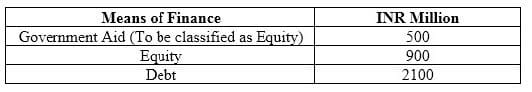

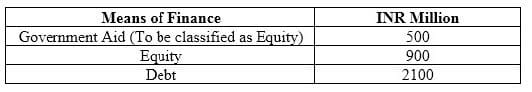

Means of finance:

Means of Finance INR Million Government Aid (To be classified as Equity) 500Equity 900 Debt 2100

5. Amount if expenditure estimated in various years is as follows: Funding Cost of Project INR Million Debt Govt Aid Equity Total FY13 (April to march) 700 0 250 450 700 FY14 1200 500 250 450 1200 FY15 1200 1200 - 1200 FY15 400 400 - 400

Debt shall bear a fixed rate of interest of 10% and all interest till DCCO shall be added to the principal. The expected principal along with capitalized interest is expected to be INR2, 400 Million (i.e.INR2100 Million debt plus INR300 Million capitalized interest). The repayment of the same shall be in 12 equated annual installments starting from FY17.

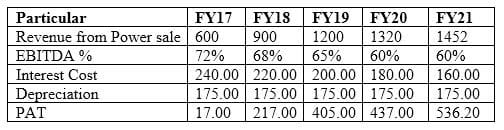

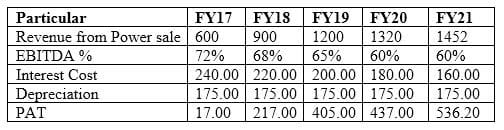

Brief projections for the period of FY17 to FY21 are given below: Developments as on March 31, 2015

The project manager for the SPV made following comments at a press conferee on March 31, 2015:

As you all are aware, we were running bang on schedule till we last met on December 21, 2014. From today we are just left with one more year to complete the project in time. However, the flash floods which struck our dam site on this March 15, 2015 have created havoc in the region. I shall not point out the loss of lives in the region as you all are well aware of those. Our project has also been badly hit due to the same and we have been assessing the damage over the last one week. After analyzing damage, we have made changes in project schedule. Now we will be making only one unit of 150 MW operational on April 1, 2016 and 1 unit each will be added in each of subsequent year(s).

Development as on September 30, 2015 Post the flash floods, lot of environmentalists started raising issues of changes in environment due to construction of large number of dams. A few Public Interest Litigations (PILs) have been filed in various courts.

Honorable High Court of MP on September 27, 2015, banned construction of any dams in the region and banned permissions for new dams till next hearing scheduled on November 30, 2015. MCC in its press release has indicated that they will apply to the higher court on the matter.

As a credit analyst on March 31, 2012, which of the following sets of risks are you going to put in your credit appraisal note?

A. Off-take risk, Cost and Time over run risk, lack of management experience in such big projects.

B. Lack of management experience in large projects, Exchange rate risks, Cost and time over run risks.

C. Cost and Time over run risk, lack of management experience in such big projects.

D. Obsolete technology risk, political risks and Cost and time over run risks

Case Facts as on March 31, 2012

Mark Construction Company (MCC) has bagged a contract for construction of a large dam and hydro power project on river Shivna in Madhya Pradesh (MP). The project is also of relevance from the irrigation perspective due to its location and as per the agreement MCC will have to undertake construction of web of canals, approach road to dam, power house and other ancillary units. MCC is promoted by Mr. Thomas Mark, who is a MP from the ruling party which recently formed government in MP. Historically, MCC has been engaged into construction of rural roads, small bridges and railway platforms on contract basis for the Government. MCC will have a separate special purpose vehicle (SPV) floated for this venture.

The hydro power project comes under the public private partnership scheme of the Government of MP, where in the private partner builds owns operates and transfers (BOOT) the hydro power plant. The detailed terms of the hydro power project agreement are as follows:

1.

The construction of the dam, canals and hydro power plant shall be undertaken by the contractor. The Government of MP will have to acquire land which will submerge on construction of dam and shall rehabilitate the owners of land.

2.

MCC shall have right to operate the hydro power project from date of commencement of commercial operations (DCCO) for a period of 20 years and shall transfer the project to Government thereafter. Further, SPV shall be tax exempt for a period of five years from DCCO i.e. FY17-FY21.

3.

The power project is of 600 megawatts (MW) shall comprise 4 units of 150 MW each. The estimated cost of project is about INR3, 500 Million to be spent over a period of 4 year(s) the project is estimated to be commercially operational by April 1, 2016 with two units operational om same day and one unit each will be operational on April 1, 2017 and April 1, 2018.

4.

Means of finance:

Means of Finance INR Million Government Aid (To be classified as Equity) 500Equity 900 Debt 2100 5. Amount if expenditure estimated in various years is as follows: Funding Cost of Project INR Million Debt Govt Aid Equity Total FY13 (April to march) 700 0 250 450 700 FY14 1200 500 250 450 1200 FY15 1200 1200 - 1200 FY15 400 400 - 400

Debt shall bear a fixed rate of interest of 10% and all interest till DCCO shall be added to the principal. The expected principal along with capitalized interest is expected to be INR2, 400 Million (i.e.INR2100 Million debt plus INR300 Million capitalized interest). The repayment of the same shall be in 12 equated annual installments starting from FY17.

Brief projections for the period of FY17 to FY21 are given below:

Developments as on March 31, 2015

The project manager for the SPV made following comments at a press conferee on March 31, 2015:

As you all are aware, we were running bang on schedule till we last met on December 21, 2014. From today we are just left with one more year to complete the project in time. However, the flash floods which struck our dam site on this March 15, 2015 have created havoc in the region. I shall not point out the loss of lives in the region as you all are well aware of those. Our project has also been badly hit due to the same and we have been assessing the damage over the last one week. After analyzing damage, we have made changes in project schedule. Now we will be making only one unit of 150 MW operational on April 1, 2016 and 1 unit each will be added in each of subsequent year(s).

Development as on September 30, 2015 Post the flash floods, lot of environmentalists started raising issues of changes in environment due to construction of large number of dams. A few Public Interest Litigations (PILs) have been filed in various courts.

Honorable High Court of MP on September 27, 2015, banned construction of any dams in the region and banned permissions for new dams till next hearing scheduled on November 30, 2015. MCC in its press release has indicated that they will apply to the higher court on the matter.

On receiving the credit proposal, the banker informed the company that in FY17 the DSCR is below unity, which is not acceptable to bank. Which of the following is correct?

A. Had the cash accruals be more by INR50 Million, DSCR would have been unity. SPV can provide an implicit credit enhancement for the same from MCC.

B. Had the cash accruals be more by INR8 Million, DSCR would have been unity. SPV can provide an implicit credit enhancement for the same from MCC.

C. Had the cash accruals be more by INR8 Million, DSCR would have been unity, SPV can provide an explicit credit enhancement for the same from MCC.

D. Had the cash accruals be more by INR12 Million, DSCR would have been unity. SPV can provide an explicit credit enhancement for the same from MCC.

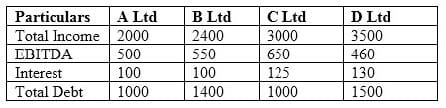

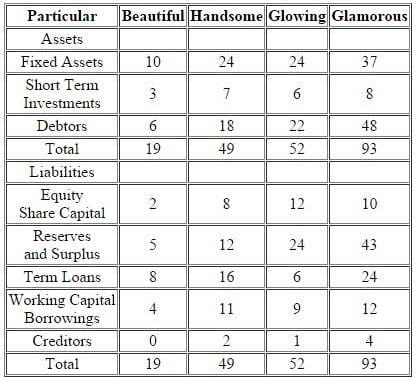

Scott is a credit analyst with one of the credit rating agencies in India. He was looking in Oil and Gas Industry companies and has presented brief financials for following 4 entities:

From the data given below, calculate the standard deviation of the credit portfolio assuming that facility's exposure is known with certainty, customer defaults and LGDs are independent of one another and LGDs are independent across borrower(s).

Credit Facility A ?Loss Equivalent Exposure of $60m, expected Default frequency of 1.5%, loss given default of 30%, Std Deviation of LGD ?5% and Correlation to portfolio ?0.10

Credit Facility B ?Loss Equivalent Exposure of $25m, expected Default frequency of 2%, loss given default of 12%, Std Deviation of LGD ?12% and Correlation to portfolio ?0.45

Credit Facility C ?Loss Equivalent Exposure of $15m, expected Default frequency of 5%, loss given default of 85%, Std Deviation of LGD ?18% and Correlation to portfolio ?0.22

A. US$6.88 million

B. US$ 1.16 million

C. US$ 1.66 million

D. US$ 0.10 million

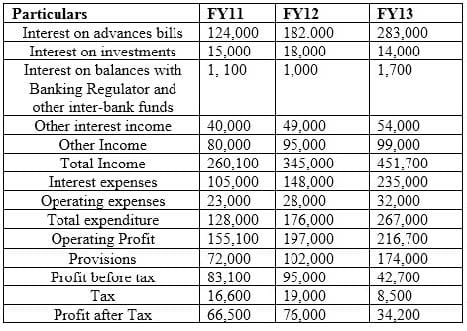

Following is information related banks:

Auckland Ltd is a public sector bank operating with about 120 branches across India. The bank has been in business since 1971 and has about 40% branches in rural areas and about 75% of all branches are in Western India. On the basis of the size, Auckland Ltd will be ranked at number 31 amongst 40 banks in India. Although top management has appointment period of 5 years, generally they retire on ach sieving age of 60 years with an average tenure of only 2 years at the top job.

Profit and Loss Account

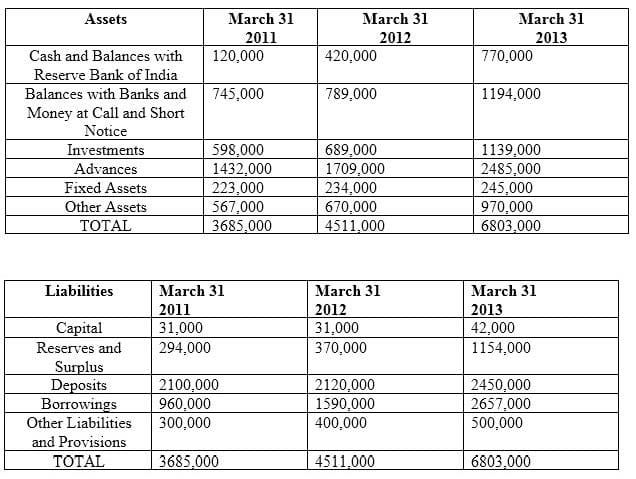

Balance Sheet

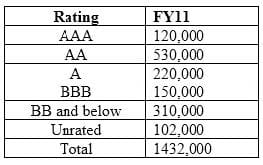

The rating wise break-up of assets for FY11 is as follows:

The core spreads for FY13 as compared to FY12 have:

A. Expanded by 136 bps

B. Contracted by 327 bps

C. Contracted by 136 bps

D. Expanded by 191 bps

"Following four entities operate in the Indian IT and BPO space. They all are into same segment of providing off-shore analytical services. They all operate on the labour cost-arbitrage in India and the countries of their clients. Following information pertains for the year ended March 31, 2013.

The year FY13, was typically a good year for Indian IT companies. For FY14, the economic analysts have given following predictions about the IT Industry:

A. It is expected that INR will appreciate sharply against other USD.

B. Given high inflation and attrition in IT Industry in India, the wages of IT sector employees will increase more sharply than Inflation and general wage rise in country.

C. US Congress will be passing a bill which restricts the outsourcing to third world countries like India. While analyzing the four entities, you come across following findings related to Glowing:

Glowing is promoted by Mr.M R Bhutta, who has earlier promoted two other business ventures, He started with ABC Entertainment Ltd in 1996 and was promoter and MD of the company. ABC was a listed entity and its share price had sharp movements at the time of stock market scam in late 1990s. In 1999, Mr.Bhutta sold his entire stake and resigned from the post of MD. The stock price declined by about 90% in coming days and has never recovered. Later on in 2003, Mr. Bhutta again promoted a new business, Klear Publications Ltd (KCL) an in the business of magazine publication. The entity had come out with a successful IPO and raised money from public. Thereafter it ran into troubles and reported losses. In 2009, Mr. Bhutta went on to exit this business as well by selling stake to other promoter(s). There have been reports in both instances with allegations that promoters have siphoned off money from listed entities to other group entities, however, nothing has been proved in any court."

What will be impact of on the predictions A and B of the economic analysts, on companies:

A. Handsome: No Impact on sales; Margins may squeeze; Glowing: INR Sales may decline; margins may squeeze.

B. Handsome: INRSales may increase; margins may squeeze; Glowing: INRSales will increase;

margins may squeeze.

C. Handsome: INR Sales may decline; margins may squeeze; Glowing: INR Sales may decline;

margins may squeeze.

D. Handsome: No Impact on sales; Margins may squeeze; Glowing: No Impact on sales; Margins may squeeze.

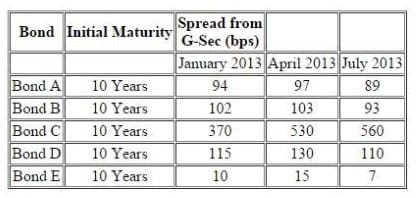

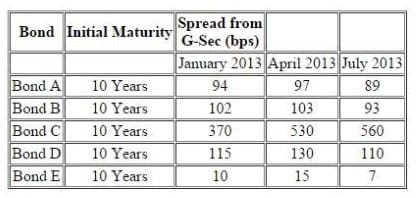

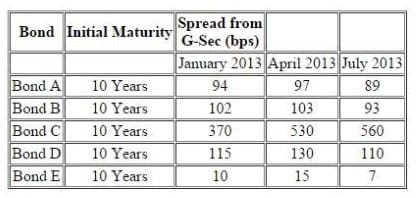

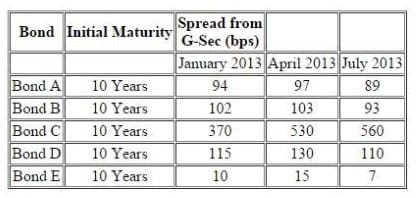

The following information pertains to bonds:

Further following information is available about a particular bond `Bond F'

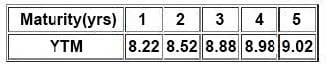

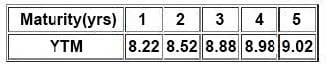

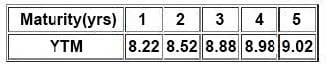

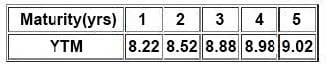

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which corresponds to YTM of 9.22%. The following are the benchmark YTMs.

From the time January 2013 to April 2013, what can you predict about the market conditions, assuming the G-Sec has not changed?

A. There has been credit spread compression, which means the spreads have declines, which can be lead indicator of oncoming economy stress.

B. There has been widening of credit spread, which means the spreads have increased, which can be lead indicator of oncoming economy stress.

C. There has been widening of credit spread, which means the spreads have increased, which can be lead indicator of oncoming economy stress.

D. There has been credit spread compression, which means the spreads have declines, which can be lead indicator of oncoming economy boom.

The following information pertains to bonds:

Further following information is available about a particular bond `Bond F'

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which corresponds to YTM of 9.22%. The following are the benchmark YTMs.

Compute interpolated spread for Bond F based on the information provided in the vignette:

A. 1.64%

B. 0.43%

C. 0.61%

D. 1.46%

The following information pertains to bonds: Further following information is available about a particular bond `Bond F'

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which corresponds to YTM of 9.22%. The following are the benchmark YTMs.

Assuming the G-Sec has not changed from the time January 2013 to April 2013, what can you predict about the changes bond price and change in issues borrowing rates:

A. Decrease and Increase

B. Increase and Increase

C. Decrease and Decrease

D. Increase and Decrease

The following information pertains to bonds:

Further following information is available about a particular bond `Bond F'

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which corresponds to YTM of 9.22%. The following are the benchmark YTMs.

Assume that the general market rates have increased. An issuer, Revolution Ltd has plans to roll over its existing commercial paper and forth coming reset dates for its floating rate bonds are very near. Which of the following ratios for revolution will get impacted?

A. Interest Coverage and Return on assets

B. DSCR, and Return on Assets

C. DSCR, Interest Coverage and Return on assets

D. DSCR and interest Coverage

In Steepening short term rates ______relative to long term rate A. falls

B. rises

C. is independent of each other

D. remains constant

Which of the following shall not be used as a source of information for the credit risk assessment?

A. Annual Report

B. Reports issued by brokerages on companies

C. Analyst Presentations

D. Concall transcripts

Which of the following are types of bank guarantee?

A. Deferred and Term

B. Financial and Performance

C. Usance and Sight

Attributes of healthy cultural values exclude:

A. Experienced management.

B. Diversified sources of revenue.

C. Brand.

D. Healthy relationship with employees

Based on the Moody's KMV model which of the following is not correct?

A: Growth variables are important for default analysis. rapid growth will lead to lower probability of default and rapid decline will lead to higher probability of default.

B:

Activity ratios are relevant for default analysis. A large stock of inventories relative to sales will lead to a higher probability of default.

A.

Only Statement A is correct

B.

Both the statements are correct

C.

None of the statements is correct

D.

Only Statement B is correct

Statement 1: The Yields on the MBS PTCs are normally higher than the yields on the corporate bonds of similar ratings. Statement 2: The reason for difference in yields on the corporate bonds and similarly rated PTCs is on account of the optionality in the PTC, the unfamiliarity of the structure and uncertainties in respect of legal and structural issues.

Which of the above statements is correct?

A. None of the statements

B. Both the statements

C. Only Statement 2 is correct

D. Only Statement 1 is correct